Pig E. Bank Customer Retention Analysis: Insights and Strategies

- Ashwani Sherawat

- Jan 19, 2025

- 2 min read

Updated: Feb 5, 2025

Tools

This project provides a comprehensive analysis of customer satisfaction and attrition at Pig E. Bank. Using data transformation, predictive modeling, and decision tree analysis, the study identifies key factors influencing customer behavior and offers actionable recommendations to enhance retention and customer loyalty.

Introduction

In a competitive banking landscape, retaining customers is critical to long-term success. This project leverages advanced data analysis techniques to explore customer satisfaction at Pig E. Bank, uncovering factors contributing to attrition and identifying opportunities to improve retention rates.

Objectives

Analyze factors influencing customer satisfaction and attrition.

Develop data-driven strategies to enhance customer retention.

Identify key customer profiles for targeted engagement.

Methodology

Data Transformation: Organized raw data into structured formats for analysis.

Data Cleaning: Ensured consistency and removed anomalies.

Data Mining: Applied techniques to extract patterns and trends.

Predictive Modeling: Used decision trees and regression analysis to forecast customer behavior.

Key Insights

1. Customer Profiles

Loyal Clients:

Mean Age: 37 years

Mean Tenure: 5 years

Average Balance: €74,646

Strong financial stability and long-term loyalty potential.

Exited Clients:

Mean Age: 45 years

Mean Tenure: 5 years

Average Balance: €90,030

Higher attrition among older, high-balance customers.

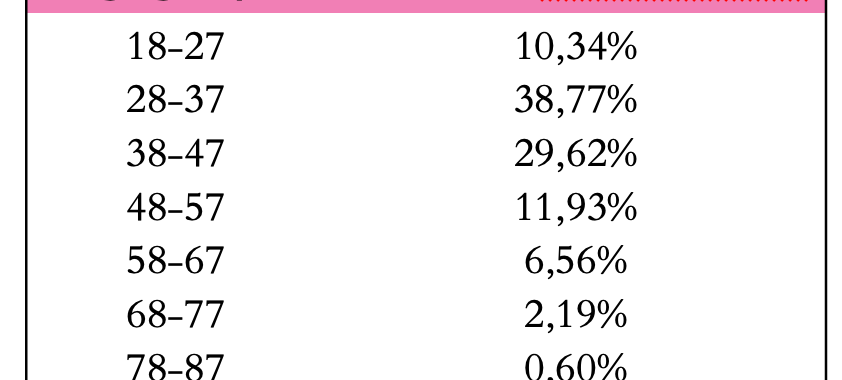

2. Age Group Dynamics

28-37 Age Group:

Largest share of active members (38.77%).

Demonstrates strong financial stability and long-term retention potential.

Older Clients (45+ years):

Higher attrition rates, indicating a need for tailored financial products.

3. Key Metrics

Credit Scores:

Loyal Clients: Average score of 652.

Exited Clients: Average score of 637.

Lower scores may correlate with dissatisfaction or unmet financial needs.

Balance Trends:

Higher average balance among exited clients suggests unmet expectations for personalized services.

Challenges and Opportunities

The analysis highlights significant opportunities to improve retention by addressing the needs of high-balance and older clients. Personalized services and targeted engagement strategies can mitigate attrition in these segments.

Recommendations

1. Tailor Financial Products for Older Clients

Develop specialized offerings, such as retirement plans or investment advisory services, to address their unique needs.

2. Engage High-Balance Customers

Provide personalized financial management services to meet the expectations of high-value clients.

3. Focus on the 28-37 Age Group

Strengthen engagement with this age group through loyalty programs and tailored marketing campaigns to build long-term relationships.

4. Improve Credit Score Support

Introduce programs to assist customers with lower credit scores, fostering trust and satisfaction.

Conclusion

The Pig E. Bank Customer Retention Analysis reveals critical insights into customer behavior and attrition trends. By addressing the needs of high-value and older clients while nurturing the loyalty of younger, stable customers, the bank can drive long-term growth and customer satisfaction.

Explore the interactive decision tree and visualizations here to gain a deeper understanding of the factors influencing customer retention at Pig E. Bank.